The world is firmly into the digitalization era. All businesses are seeking creative ways of working by utilizing technologies and creating advantages over competitors in the industry.

The logistics industry is one of the business sectors that cannot avoid this disruption. Transport and Logistics service providers need to enhance their services to match with the evolving industry, respond to customers’ expectations and stay ahead of their competitors.

Amid this historical transformation, LM had the pleasure of speaking to Ms. Supinda Panprom, General Manager, Finance & Accounting Division, Ocean Network Express (Thailand), and Mr. Pichit Wiwatrujirapong, Chief Executive Officer and Founder of Netbay. They explained how ONE’s e-tax Invoice/e-Receipt service helped the ocean carrier to fully digitize their status quo and improve customers’ experience along the journeys.

Streamline and Digitize Documentation Process

Considering the time spent, the process of duplicating and archiving, and human resources contribute to the traditional paper-based document management system, the entire process of managing receipts and tax invoices in digital files is way more effective. In addition, during such a pandemic situation, avoiding close contact and direct touch has been the key to reducing the spread of COVID-19.

“Responding to the pandemic from the beginning, we issued a new policy for receiving receipts to reduce contact and crowded at service counter which can reach 600 queues on a peak day. By making an appointment for customers to pick up their receipts later. While we had managed the immediate situation; to increase the efficiency in handling this challenge in the long term, we turned to document digitization and executed the project in July 2021. We launched an e-Tax Invoice/e-Receipt program, and became the first shipping line in Thailand to provide the customers with direct and seamless connection to The Thai’s Revenue Department (RD),” said Ms. Panprom.

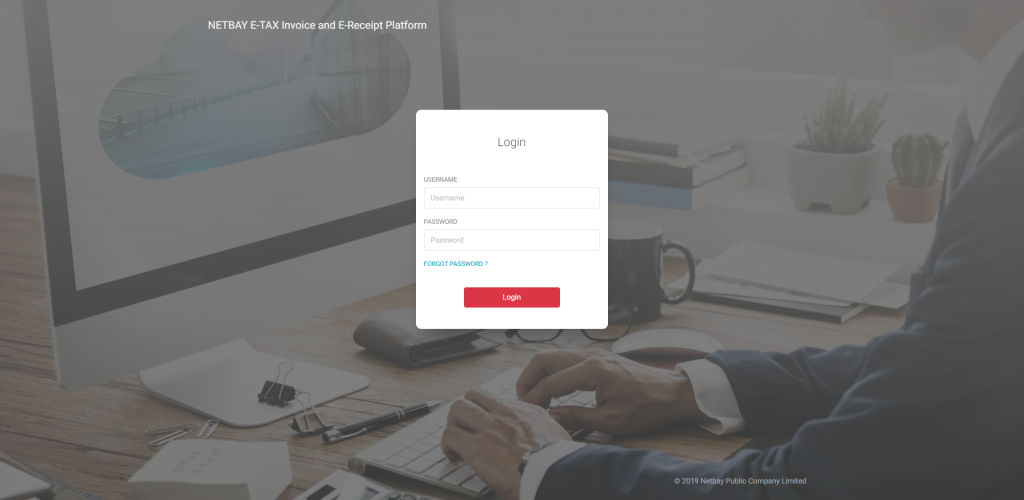

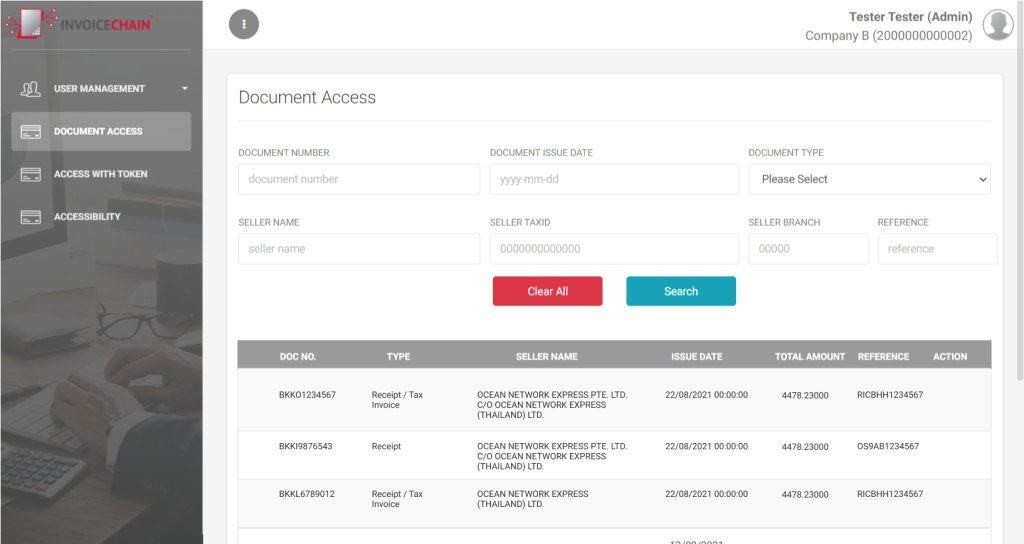

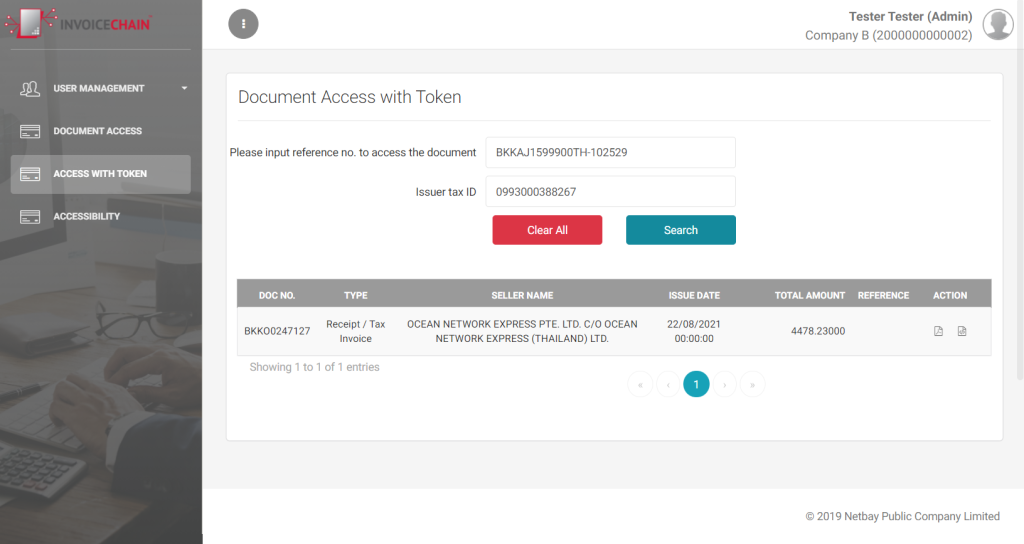

With the RD’s new regulation for big companies to integrate into the electronic tax invoice system, ONE Thailand aimed not only to digitize the information to improve their process agility but also to coordinate with the government department seamlessly. Netbay, a leading cloud computing software provider in Thailand, has been entrusted with ONE’s e-Tax Invoice and E-receipt platform. Facilitating with all ONE Thailand’s stakeholders, the platform allows access to electronic receipts and tax invoices with a few clicks.

Deliver Better Experience

Planned and initialized the Digitalization Roadmap in December 2020, ONE Thailand aimed to utilize the digital technology to develop better contact channels, operation, and data management. The digital process covers the booking quotation to the issuance of electronic documents. Currently, ONE’s digitized services cover almost all the electronic transaction processes, providing customers with a fully integrated digital experience.

แพลตฟอร์มแสดงรายการใบเสร็จในระบบทันทีโดยไม่ต้องค้นหา

Pointing out the benefits of the new e-Tax Invoice/e-Receipt, Ms. Panprom said: “The e-Tax Invoice/e-Receipt Service will save the customers from waiting for paper receipts at the front counter, reducing the burden to physically pick up the documentation and messenger costs. The system also helps reduce exposure to and the risk of infecting with COVID-19. Customers only need a one-time registration to the system, access to the receipt information, downloading documentation, and printing out can be done any time afterward.

The e-Tax Invoice/e-Receipt service not only helps save time for the customers but also gets rid of complex beurocratic customaries such as reporting to the police to reissue a lost receipt. The new system allows a customer to reprint their receipts as much as they want whenever they want to. Saving time for searching through a physical paper archive to find an old original document. Forwarding information to partners and the RD is an instant, compared to the traditional processing.

“Users of ONE Thailand’s new digitized system, be it an import/exporter, freight forwarder, ship agent or custom brokers can be beneficial from the documentation management flexibility, convenience and secure access to the data, and a huge cost reduction.” Ms. Panprom said.

Safeguard the Security

Integrating digital technology into a data storage and communication system, security is of paramount importance. Especially for the financial transaction process, where security and integrity are fundamental components that a service provider must provide to their customers. In the case of ONE, the OPUS system acts as their command center in managing data and verifying the accuracy of important documents. Putting the operation of all ONE office under the same strict security standards, the Thai office is connected to this same central system as the head office.

Ms. Panprom explained the security procedures via the OPUS system: “The process of issuing a receipt begins with the OPUS system automatically issuing the receipt number. After that ONE staff will verify and stamp an electronic signature (e-signature) to confirm the integrity of the receipt before issuing it to the customer. On the customer side, they have to register and verify their authenticity as a one-time process. Once authenticated, they can download their receipts via the e-Tax Invoice/e-Receipt system at their convenience. The registration process is manually done by ONE’s staffs, it currently takes less than one working day by a dedicated registration team set up specifically for the process.”

“Many customers are accustomed to receiving documentation via email. Email, however, is a very risky way of communicating and sending sensitive information. Users can be spammed or have information stolen by hackers, which can cause grave damage to the corporation. Netbay encounters the situation regularly and designed software to secure sensitive documentation in a Cloud Computing system. The PDPA certified system, which is used in ONE’s e-Tax Invoice/e-Receipt service, allows only authenticated parties to enter and access their data securely and conveniently via the internet. Users include customers of ONE Thailand, the Thai RD department, and OPUS administration officer from ONE Head Quarter.” Mr. Wiwatrujirapong said.

“We will continue to improve our services, focusing at maximize customer satisfaction. In the case of the e-Tax Invoice/e-Receipt service, if users experience any problems, we have a dedicated support team via email and call center with 10 telephone lines ready to take care of any registered customers’ issues.” Wrapping up, Ms. Panprom.

The e-Tax Invoice/e-Receipt is only a part of ONE Thailand’s digital services provided to the customers. Other digital services include ONE Quote, e-Commerce, e-B/L, e-Service, Live Chat, and the recently launched ONE Mobile Application.

To register the e-Tax Invoice/e-Receipt click here https://bit.ly/3HpPX1g

อัพเดตข่าวสารและบทความที่น่าสนใจในอุตสาหกรรมโลจิสติกส์ก่อนใคร ผ่าน Line Official Account @Logistics Mananger เพียงเพิ่มเราเป็นเพื่อน @Logistics Manager หรือคลิกที่นี่