Drewry is reporting that reefer container freight rates have risen sharply this year but remain far outgunned by the rise in dry box pricing, according to the company’s newly launched Reefer Shipping Forecaster report.

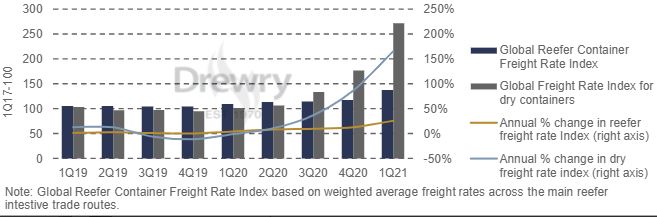

Drewry’s Reefer Container Freight Rate Index, a weighted average of reefer freight rates across the top 15 reefer intensive trade lanes, jumped 26% in the first quarter, on a seasonal uptick in cargo demand and rising bunker surcharges. This was its highest level since the Index was launched in 1Q17 and rates are expected to rise further through the second quarter. However, these increases are modest compared to the inexorable rise in dry freight rates, as illustrated in the chart below.

“Tight container equipment availability and a shortage of slot capacity have been key drivers in forcing up freight rates, as a recovering reefer trade has struggled to compete for space with higher-paying dry cargo traffic,” said Drewry’s head of reefer shipping research Philip Gray. “Despite record levels of reefer container production in 1Q21, Drewry expects equipment availability to remain tight over the next few years.”

Meanwhile, container supply chain disruption has greatly increased demand for specialized reefer ships, driving time charter equivalents above the 100 cents/cft/30 days threshold, representing the strongest period of trading in a decade. Indeed, trade for these vessels is so buoyant that Drewry expects the fleet to expand this year, breaking a 20-year declining run, though contraction is anticipated to continue thereafter.

Meanwhile, the recovery in seaborne perishables trade is expected to be muted this year by the Fusarium TR4 disease afflicting banana production. Worldwide shipments rose just 1.8% in 4Q20 and growth has slowed further since. Over the last 12 months the Philippines, the second-largest banana exporter, has been notably affected by the diseases, where exports contracted by as much as 18% in 2020. More recently Peru has reported an outbreak of Fusarium, which has led to a state of high alert not only in Peru itself but in neighboring Ecuador, the world’s biggest banana exporter.

After contracting 0.4% to 130 million tonnes in 2020, Drewry expects the recovery in seaborne reefer traffic to be limited to 2.7% this year, before accelerating thereafter to an average annual growth rate of 4%. The decline in the size of the specialized reefer vessel fleet will see containerized perishables traffic expand at a faster pace over the medium term, to a rate comparable with the dry cargo trade.

“Despite modest cargo growth this year, reefer container freight rates are advancing further through the sector’s peak season and are expected to remain high through much of the year, supported by continuing disruption across the container supply chain. The same drivers will continue to buoy specialized vessel charter rates,” concluded Mr. Gray.

อัพเดตข่าวสารและบทความที่น่าสนใจในอุตสาหกรรมโลจิสติกส์ก่อนใคร ผ่าน Line Official Account @Logistics Mananger เพียงเพิ่มเราเป็นเพื่อน @Logistics Manager หรือคลิกที่นี่